Neil McCoy-Ward Presents

The ULTIMATE Gold & Silver Mastery Bundle

Extremely Limited spaces available per day, (try again tomorrow if you can’t gain access today).

The 5,000-Year-Old Crisis-Proof Wealth Strategy

People Are Quietly Returning To Today

Your savings are being decimated by rampant inflation… reckless government spending…and soaring taxes. Discover this one timeless strategy to protect and grow real wealth when everything else is failing…

Do you ever look at your bank account and wonder, “Where is it all going?”…

You’re not spending wildly…

You’re doing what you’ve always done: buying groceries, paying bills, trying to get ahead. And yet, somehow, every month your finances feel tighter than the last…

Prices are rising faster than paychecks.

UK grocery prices up 25% since 2021 (ONS)

Weekly shop £70 → £100–£110

Energy bills have doubled since 2020

Council tax, car insurance, essentials up 30–40%

Wages rising only ~5%

US grocery costs up 25% since 2020

Milk $2.85 → $4.19

Eggs $1.60 → $3.30

Rent up 22–40%

Extra $11,400 per household (CBS News)

GOVERNMENT DEBT & INFLATION

In short, governments keep printing money to “fix” problems caused by… printing money… It’s insane…

Let’s say it plainly: The financial system is no longer being managed. It’s being propped up…

In the United States, the national debt is now over $38 trillion. Just servicing that debt - not paying it down - now costs roughly $1 trillion a year in interest alone…

Britain’s national debt stands at £3.2 trillion… (and counting). To service this debt now takes over £110 billion every year in interest payments.

And that cost is carried by YOU!

Your higher grocery bills, your rising fuel costs, your shrinking savings, your frozen wages, your tax increases disguised as “adjustments.”

Your wealth is simply eroded quietly, month after month, year after year,

while politicians stand in front of podiums, saying everything is “under

control”

This isn’t mismanagement…

This is a wealth transfer…

Slow…Silent… Deliberate…

It’s not just unfair. It’s the biggest financial betrayal of our lifetime.

But There’s Good News - If You Act Now

You cannot control government spending, interest rates, monetary policy, or inflation…

But you can control the structure of your savings…

And right now, while the system is still intact, there is a proven, crisis-resistant strategy that can protect your wealth and even grow it as currencies weaken…

A strategy that has:

Survived every debt crisis in recorded history… Protected families across empires and ages… Outlasted every paper currency ever created… And continues to strengthen when confidence in governments falls…

I’ll show you what this strategy is in just a moment but first…

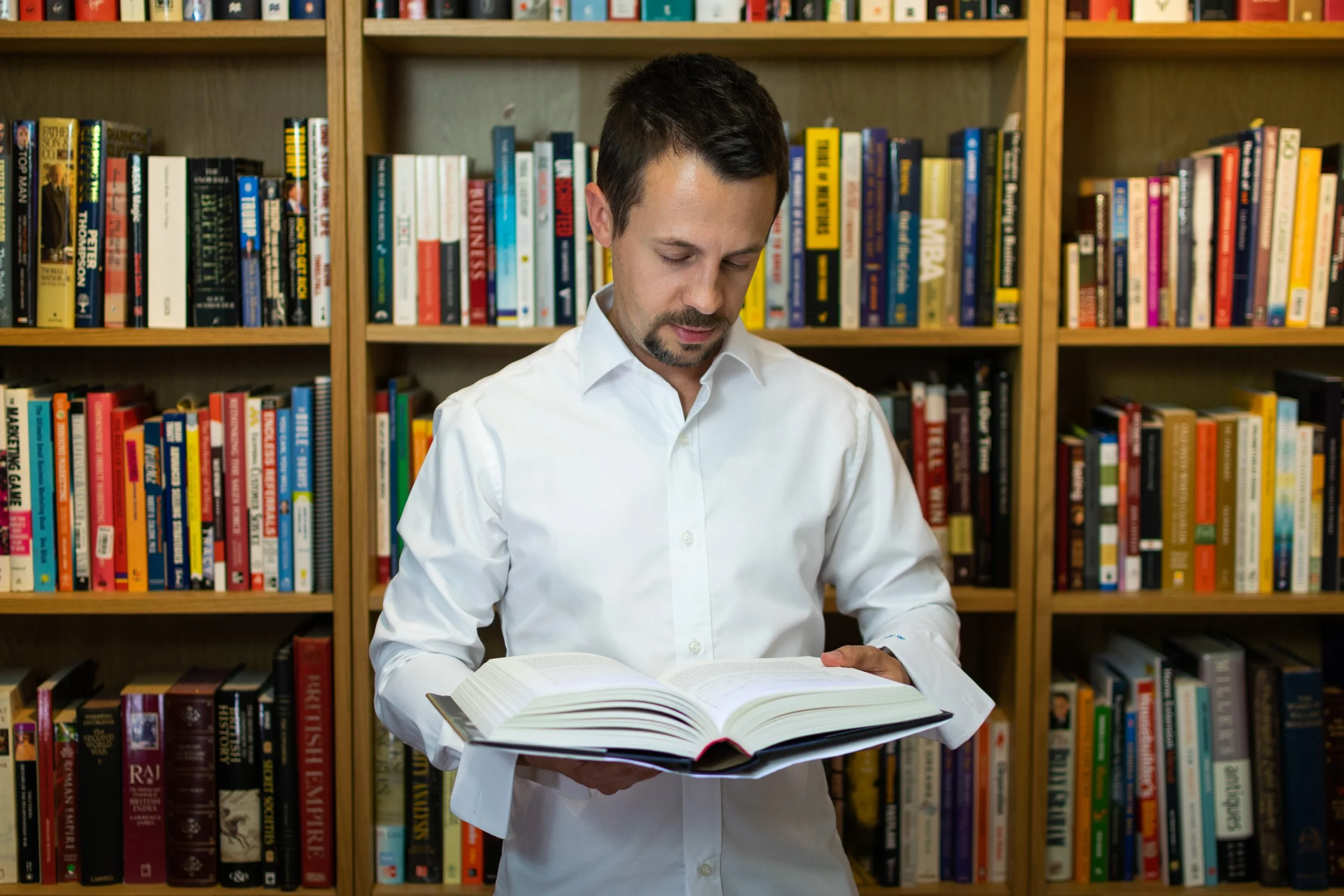

As you may know, I have a YouTube channel with 540,000+ subscribers. Here I report on the economic news the mainstream refuses to comment on…

I also write The Neil McCoy-Ward Newsletter. Every week, I round up the geopolitical and macroeconomic news for my 20,000+ subscribers…

I’ve been a paid consultant to 60+ celebrities… hundreds of CEO’s worldwide….and 2 managers for Wall Street hedge funds – Goldman Sachs and JP Morgan…

As a result of my economic know-how, I’ve been able to become a multi-millionaire and even buy a castle on the Isle of Man. But enough about me…

Allow me to Introduce Myself

I’m Neil McCoy-Ward

There Is a Way to Protect What You’ve Built

There is a proven way to safeguard your money when paper assets and political systems are failing…

A financial haven that’s worked for more than 5,000 years through every empire, crisis, and collapse…

What is this financial haven? That’s so resilient in financial chaos… That doesn’t lose its value… That grows in value when paper money is losing its value…

It’s those precious metals…

GOLD and SILVER.

Yes, that’s right, the precious metals the media doesn’t talk about much.

The same metals that have doubled in value in the past 2 years.

In fact, according to Trading Economics, gold and silver are up around +45-50% year-on-year…

Recently, queues of people 50 yards long were spotted outside the offices of ABC Bullion, Sydney, Australia. This tells its own story. People are slowly waking up. And looking to trade their savings in exchange for precious metals.

5,000 Years. Zero Failures

Look, history has a message for when currencies are collapsing. And it’s written in gold and silver…

Whenever money loses value… Whenever trust in the system breaks… Whenever the future becomes uncertain…

Gold and silver have consistently preserved purchasing power, regardless of the era or the economic structure

Ancient Rome to Modern Times: Purchasing Power That Never Fades

In ancient Rome, gold wasn’t wealth to be traded. It was wealth itself.

A single ounce of gold - whether in the form of four Aurei coins or equivalent weight - could outfit a Roman citizen with:

A well-tailored toga…

A pair of leather sandals…

And a quality belt appropriate for everyday public life…

Not extravagant. Not royal. Just a respectable, dignified appearance for a person of decent standing… And today?.. A single ounce of gold still buys:…

A well-tailored suit…

A pair of quality leather shoes…

And a quality belt of similar social status…

And that’s after two thousand years!...

During that time, empires rose and collapsed. Currencies came and went. Political systems have changed. Wars reshaped nations…

But gold’s buying power stayed the same. But paper money decreased…. This is what makes gold a haven, it protects real value across time… And this is critical in times of financial chaos like…

The Great Depression: The Ultimate Test of Wealth Survival

When the stock market collapsed in 1929, most people lost nearly everything…

Portfolios fell 90%...

Bank failures wiped out life savings overnight…

But gold didn’t fall…It rose…

Not a little - but 70% in real value, while nearly every other asset imploded…

If you held stocks, you were ruined…. If you held cash, inflation eroded it… If you held property, liquidity vanished…

But if you held gold. Your wealth survived… It didn’t just hold - it strengthened. Gold is not a speculation. Gold is wealth insurance when the system fails…. Just as happened in the 1970’s

The 1970s Inflation Crisis: When Money Lost Value Every Month

The 1970s were another moment of financial fracture.

Inflation hit double digits – (the same as today when you ignore the government Consumer Price Index lies.)

Savings accounts paid almost nothing… People watched their money weaken month after month…

But gold didn’t weaken… It surged by 2,300%...

What $1,000 in cash lost…$1,000 in gold multiplied many times over…

This wasn’t luck. This wasn’t timing. This was the inevitable counter-balance…

When currencies fail, gold rises. Not by chance - but because gold represents real, permanent value…

The conclusion is unavoidable:

Gold doesn’t just survive crises. Gold is specifically designed for crises. Because it is…

Finite (cannot be printed)…

Borderless (recognized everywhere)…

Timeless (never expires)…

Independent of governments (no one can dilute it)…

This is why central banks - the institutions printing money - have quietly…

Bought over 1,000 tonnes of gold per year for the last four years…

That’s according to The World Gold Council. That’s double what they have been buying

Across Every Major Crisis in History, the Pattern Holds

But Most People Get This Wrong

Here’s the crucial part:…

Most people who buy gold and silver today are doing it wrong…

They’re:…

Paying retail prices instead of wholesale…

Buying collector coins instead of true bullion…

Storing metals in places they don’t control…

Treating gold like a speculative investment…

And that defeats the entire purpose…

Gold and silver aren’t meant to be “trades.” They are meant to be wealth insurance. A financial safety foundation that holds value when the system does not.

But almost no one is teaching ordinary savers how to do this properly.

So what happens?

People end up:

Overpaying by 15–40%...

Holding metals they can’t resell…

Storing metals they can’t access…

Or relying on financial products that aren’t real metal at all…

Which means they think they’re protected…But they’re not…

And that is a devastating tragedy during times like these, because the right approach can:..

Lock in lasting purchasing power…

Stabilize your financial future…

Protect you against inflation…

Preserve your savings from government overreach…

And give you peace of mind no paper asset can provide…

But the wrong approach? It’s just another way savers get taken advantage of…

A Unique Training

Gold and Silver Mastery Bundle Program

It comprises two programs; Gold and Silver Foundation and Gold and Silver Advanced…

“It’s NOT just “buy some gold.” It’s why, when, how and what to avoid. Seriously opened my eyes,”

— Priya K, India“I always thought gold was for doomsday preppers. Neil breaks it down in plain english. Now I understand why metals matter, how to buy, where to store and mistakes to avoid,”

— Daniel M, Glasgow, Scotland“This program OVER-delivers. Every section hit harder than the last; Tools, history, future strategies”

— Leanne F, Manchester, UK

The Expensive Silver Mistake

But why would you want a gold and silver program? After all, anyone can go to a high street jeweler. Or buy bullion online.

Let me answer with a quick story….

I was talking to one of my YouTube subscribers. After 2020, he’d become concerned about the world economy. And what this would mean for his savings. So he went online and bought silver coins.

All well and good, right?..

Wrong…

He bought silver Canadian Maple Leaf coins. He’d been told by a “friend” that these are the best silver coins to buy…

Big mistake…

What he should have done is buy a coin that could be used as currency in his country. And a coin that would NOT incur any tax when he decides to sell it. This common mistake could see him paying thousands in capital gains tax to the government…

And there are many more secrets you need to know about gold and silver before purchasing a single coin or bar….

For instance, there are the common scams….

Way over-priced coins…fake bars and coins… false promises from bullion companies… The common “government imposter” scam… precious metal mining investment lies… the post-purchase hoax… The great storage lie…

Buying precious metals can be a minefield for people relatively new to precious metals – unless you know what you’re doing…

And that’s why I go into great detail about precious metal scams in my Gold and Silver Mastery Bundle. So you invest in the right type of metals for your situation. And avoid losing your hard-earned money. Or being scammed out of your metal holdings...

This way you have peace of mind over your metal investment. And secure your savings for you and your loved ones...

But…

Let me give you a taste of what you’re going to discover in this breakthrough program

ETFS Are Not Gold.

One of the common mistakes I’ve seen over the years when investors buy metals is this;…

Investors buy into a precious metals Exchange Traded Fund (ETF)…

On the face of it, ETFs seem brilliantly simple. Open a brokerage account, buy a ticker: GLD for gold, SLV for silver - and boom, you’re in. .. No vaults. No safes. No insurance. You can trade them just like any stock, and the price appears to follow the metal. Easy, right?...

Wrong….

Here’s the catch: you’re NOT actually buying gold. Because when you buy into an ETF, what you own is a share in a fund. You’re a shareholder - not a titleholder. You don’t own the physical metal. You don’t own a bar, not a coin, not even a gram. It’s entirely different from owning the real thing.

So, what does that mean in practice?...

It means you’ve got price exposure, not metal ownership… And in a world where trust in financial systems can erode overnight, that’s a big distinction. If there’s ever a liquidity crunch, a breakdown in confidence, or a disruption in the delivery chain, you’re not holding gold. … You’re just holding paper… Because there's more paper precious metals than there is physical metal in the world, if everybody tried to claim their paper metal at the same time, there simply wouldn't be enough physical metal…

So if you’re going to invest in gold and silver, make sure you buy the physical form… Now let me reveal another nugget from my Gold and Silver Mastery Bundle…

The Legal Precious Metal Tax Loophole

What I’m about to show you is something very few savers or investors in the UK know - yet it can make an enormous difference to your future wealth.

In fact, it allows you to legally avoid paying any Capital Gains Tax on your precious metals… and to keep 100% of any profit you make…

All legitimate. All supported by UK law… In the United Kingdom, certain gold and silver coins are classed as legal tender…Because they are legal currency, they are completely exempt from Capital Gains Tax…

Which means: If gold doubles… Or triples… Or even far more over the coming years…

Your gains are entirely tax-free…

On top of that:.. Investment-grade gold is exempt from VAT… And certain silver coins purchased under the margin scheme can avoid full VAT charges as well….

This is not a loophole. It is simply the law - one most people were never taught to use….

So to repeat — there is a legally recognised way to own gold and silver in the UK that:

Protect your savings…

Keeps any gains fully tax-free..

And removes government hands from your wealth…

Just as gold has protected purchasing power for 5,000 years,.. …

This method helps ensure you keep what’s yours - without extra tax erosion…

Gold & Silver Ratio Strategy

Gold and silver move in relation to each other. This relationship is tracked through something called the Gold/Silver Ratio.

And here’s the key: When you know how to read this ratio - you can exchange gold for silver, or silver for gold - at moments when one metal is historically mispriced… This allows you to increase your total ounces of precious metals over time… without spending more cash. You’re simply trading smarter, not paying more…

When the gold/silver ratio rises sharply, it’s a strong signal that silver is undervalued relative to gold. This often happens during periods of financial stress, market fear, or a rush into perceived “safety.”...

That’s your moment to shift some gold into silver. You are quite literally exchanging something expensive for something temporarily on sale. You get more ounces for the same value…

Then - later - when the ratio compresses back downward - the relationship reverses. Now silver is the more richly priced metal…

This is your cue to trade silver back into gold - at a much more favourable rate… Repeat this cycle during major ratio swings - and your precious metals holdings can grow steadily over time… It lets you:

Build wealth quietly…

Without increasing financial exposure…

Without depending on luck or timing…

And without needing markets to “go up”...

You are using the market’s natural swings to your advantage…

To repeat:... You are not trying to predict the future. You are simply exchanging whichever metal is expensive today for the undervalued one… And when the pendulum swings back - as it always does - you convert again… ending up with more metal every cycle.

Your savings grow not because you put in more money… …but because you used the ratio wisely…. This is how precious metals can move from being just “insurance”… to becoming a long-term wealth-building engine….

Look, there’s so much more I want to reveal about investing in gold and silver, but I simply don’t have room here. That’s why all these insider strategies are available to you in my Gold and Silver Mastery Bundle.

✅ Gold & Silver INVESTING: Core Program (Value: $2,000)

✅ Gold & Silver ADVANCED: Core Program (Value: $3,000)

✅ Bonus #1: Balanced Portfolio Blueprint (Value: $197)

✅ Bonus #2: Crisis Preparedness Toolkit (Value: $197)

✅ Bonus #3: The Ultimate Metal Buyer’s Checklist (Value: $197)

✅ Bonus #4: Neil’s Analysis: Going All-In on Silver (Value: $297)

✅ Bonus #5: Vaulting & Storage Masterclass (Value: $297)

✅ Bonus #6: Comprehensive Tools & Resources (Value: $297)

Here’s What You Get:

TOTAL VALUE: $6,482+

Today $5,000... $427 (Save $6,055)

Your 6 FREE Bonuses - Value $1,482

-

A strategic guide for protecting wealth during systemic financial collapse, currency failures and economic emergencies. Inside your FREE Bonus report you’ll discover…

Early warning signs indicating a serious economic crisis is underway. Look for the media and officials doing this…

4 safe countries to safely store metals in. And one country to avoid at all costs…

Clever strategy to legally hide your metal buying from the government. Use this insider method

Move gold cross-borders without being taxed. Even tens of thousands of dollars. Perfectly legal…

Bullion dealers are a great place to buy precious metals, right? Wrong. When you should never ever buy from one….

And much, MUCH more…

The Crisis Preparedness Toolkit is yours absolutely FREE when you take a risk free trial of the Gold and Silver Mastery Bundle…

-

Don’t buy a single ounce of precious metals before seeing this list.

You’ll refer back to it time and time again. It keeps your precious metal buying on track. It keeps your metals safe. And it ensures a safe exit strategy. In particular you’ll discover secrets such as…

Is your gold disguised as lead? Give away signs to look for.

Rogue bullion dealer warning signs. Are you about to get ripped-off?

Avoid paying high premiums. Do this simple check beforehand.

Worried you won’t be able to sell when you want? Magic words to ask your seller.

And much, MUCH more…

This valuable checklist is included FREE in your Gold and Silver Mastery Bundle.

-

While most people are guessing… hoping… reacting…to the markets and headlines…

A smaller group takes a different path. They use a balanced, crisis-resistant wealth structure that:

Doesn’t depend on constant growth… Protects purchasing power over decades… And works in every economic climate… This blueprint outlines that structure step by step…

No hype. No chasing the next hot thing. Just a calm, proven way to build wealth that lasts. Once you see this, you’ll wish you had discovered it years ago…

-

There is a quiet world of gold and silver investors who:...

Store metals in international vaults…

Track market signals with institution-grade tools…

Use simple models to grow ounces over time…

And stay completely outside the financial dragnet…

Most people never enter this world because they don’t know it exists.

This special report opens the door. Think of it as the map - the one insiders use - to protect and grow wealth privately, securely, and intelligently… without asking permission.

Once you see what’s inside, you’ll never go back to “just buying

coins” again.

-

If you’re going to own precious metals… own them correctly. There is a right way and a wrong way to build a bullion portfolio…

The wrong way:...

Pay unnecessary premiums…

Leave metals unprotected…

Store everything in one place…

React emotionally to price swings…

Most investors do this without realizing it…The right way is disciplined, structured, and efficient…

It lets you accumulate more ounces, lower your risk, and sleep well…

This special report walks you through the approach - in 15 simple, practical steps - so you can start building a portfolio that actually does its job:...

Protect your wealth…

If peace of mind is the goal - this is how you achieve it.If you want your precious metals to be more than a hope… this report is essential…

-

Most Silver Buyers Miss This Completely”

There’s a quiet shift happening among people who are serious about protecting their savings. They’re no longer just “buying gold and silver and hoping for the best.”

They’re using a strategic framework that helps them:

Balance metals with income-producing assets…

Spot when silver is under-valued…

Choose physical bullion over paper substitutes…

Store metals in tax-efficient, secure ways…

And position for the profit phase of the next economic downturn

This isn’t speculation. It’s not timing the market. And it’s not about betting everything on one asset.

It’s about knowing how gold and silver behave across real economic cycles… and positioning yourself before everyone else catches on.

Inside this guide, you’ll see:

Why some metal investors keep growing their holdings - while others sit stuck…

The simple indicator that quietly signals when silver is “on sale”...

The simple way to structure physical storage without VAT headaches…

Why physical silver plays a different role than ETFs and “paper claims”...

And how to use recession phases to your advantage…

You don’t have to be an expert. You just need the right sequence, applied consistently. And that’s exactly what this guide gives you - step by step….

No hype. No guesswork. No overwhelm….

Just clear, practical, real-world direction for building a metals position that can withstand what’s coming….

If you’ve ever wondered how some people always seem to be “in the right place” before prices move… then this is the playbook they use. So make sure you get this Bonus Report TODAY…while it’s still available…

GO THROUGH MY PROGRAM

RISK FREE FOR 30 DAYS!

100% Risk Free

30 Day Money Back Guarantee!

And besides you’re NOT risking a single penny of your own money here.

Take a full 30 days to dive into the Gold and Silver Bundle. See how in-depth they are. Discover everything you need to know to protect and grow your wealth by investing in gold and silver…

If after 30 days you’re not delighted in anyway, simply contact me for a full unconditional return of your money. And you’ll receive a prompt refund. ..

However, I’m confident you won’t want a refund. That’s because I have one of the lowest refund rates on the platform where the Bundle is available…

Let me leave you with a final thought…

If you have $100,000 in savings - at 10% annual inflation - your $100K is losing 10% of its purchasing power every year...

So after 12 months your $100K buys $90,000 of goods. And the following year your $100K only buys $80,000. In five years your $100K only buys $50,000.

The only way to stop a lifetime of hard work being destroyed by foolish politicians is to know the secrets of investing shrewdly and safely in gold and silver.

The Gold and Silver Mastery Bundle gives you everything you need to be a shrewd metal investor. For the sake of you and your loved ones, make the right decision TODAY.

Frequently Asked Questions:

-

Take 30 days to go through my program & if you're not completely satisfied with what you’re learning...

Just send me an email within those 30 days and you’ll receive a full refund...

But why would I offer a guarantee this strong, and let you go through the first 50% of my course at my own risk?

Because I know the knowledge in this program can change lives! It’s transformed my own; look at where I came from! And if you take action, it can change your life too...I can’t think of a more fair and reasonable offer than that.

FINAL NOTE: You May Watch Up To 50% Of This Course Before Requesting A Refund...

If You Watch More Than 50% Of This Course -

NO Refund Will Be Given. -

All orders are processed through a very secure network

Your information is never shared with a third party

-

No! These principles apply globally.

-

Once you purchase the bundle, you gain lifetime access to both the INVESTING and ADVANCED courses, including all future updates. You can revisit the material as often as you like, at your own pace.

-

Yes! Upon completion of both courses, you will unlock a Certificate of Achievement to recognize your investment education success.

-

Yes! You can purchase the bundle as a gift during checkout by entering their name and email address instead of yours. If you need assistance, reach out to us at enquiries@neilmccoyward.com.

-

-Firstly, many people who had issues finally had success by switching off their VPN and checking out on the Chrome browser

- Next, Try using a different device to checkout

- Try using a different payment card

- Try using a different web browser, especially if you have a pop up blocker enabled (for example: Chrome often works, Safari & Brave sometimes doesn’t) - it’s hard to pinpoint the exact browser issue sometimes

- Try updating your browser to the latest software

- Your bank may be blocking the transaction (usually referred to as SCA) or may need to send you a verification code

- If using a VPN, your bank might be blocking the IP address

- You may not have an online payment gateway (have not purchased something online using this card before)

- You may already have an account with Teachable and need to log in first before purchasing

- Travel: if you are currently travelling, (e.g. US bank card but you are in Europe), then the payment may not work due to Teachable security measures… if this is the case, you may need to wait until you return home OR contact Teachable and explain the situation

- Additionally, make sure that you do not have: Billing/IP mismatch, IP distance, incorrect names on credit card inputs.

These are the common checkout issues...

ERROR Message At Check Out? See the tips below:

- Firstly, many people who had issues finally had success by switching off their VPN and checking out on the Chrome browser

- Next, Try using a different device to checkout

- Try using a different payment card

- Try using a different web browser, especially if you have a pop up blocker enabled (for example: Chrome often works, Safari & Brave sometimes doesn’t) - it’s hard to pinpoint the exact browser issue sometimes

- Try updating your browser to the latest software

- Your bank may be blocking the transaction (usually referred to as SCA) or may need to send you a verification code

- If using a VPN, your bank might be blocking the IP address

- You may not have an online payment gateway (have not purchased something online using this card before)

- You may already have an account with Teachable and need to log in first before purchasing

- Travel: if you are currently travelling, (e.g. US bank card but you are in Europe), then the payment may not work due to Teachable security measures… if this is the case, you may need to wait until you return home OR contact Teachable and explain the situation

- Additionally, make sure that you do not have: Billing/IP mismatch, IP distance, incorrect names on credit card inputs.

These are the common checkout issues...

To your success - Neil McCoy-Ward

PS. When confidence in money fades… real wealth moves back to real assets. This is exactly what central banks are doing. It’s what long-standing families of wealth have always done. And it’s what more and more ordinary people are beginning to rediscover.

The only question is whether you will be one of them.

PPS. Extra FREE Bonus (value $297). You’ll also receive a FREE lifetime subscription to The Neil McCoy-Ward Newsletter. You’ll be joining 20,000+ subscribers. Every week I write my macro-economic and geopolitical newsletter. Inside, you’ll discover the week’s top economic stories, market updates, and crypto movements. So you’ll be up-to-date with what’s happening in under 15 minutes.

Your lifetime subscription starts when you take a risk-free trial of the Gold and Silver Mastery Bundle. To start click on the link below. You’ll be glad you did.